आपका वीडियो जल्द आपको मिलेगा नीचे स्क्रॉल करें

In the blink of an eye, everything you’ve worked hard to build could be swept away by an unexpected disaster. Imagine coming home to find your cherished property reduced to rubble, your memories scattered, and your financial security hanging by a thread. This isn’t a far-fetched scenario—it’s a reality many homeowners face each year. That’s why understanding the intricate world of homeowners insurance isn’t just important—it’s absolutely crucial.

The Hidden Landmines of Property Insurance Most Homeowners Overlook

Homeowners insurance is more than just a piece of paper or a checkbox for your mortgage. It’s a complex financial shield that can mean the difference between total devastation and manageable recovery. Yet, most people approach it with a dangerous mix of confusion and complacency.

In this comprehensive guide, we’ll dive deep into the strategies that can transform your homeowners insurance from a mundane annual expense to a robust protection plan tailored to your unique needs.

Understanding the True Cost of Inadequate Coverage: A Real-World Perspective

Let’s start with a sobering statistic: According to the Insurance Information Institute, nearly 95% of homeowners are underinsured. This means when disaster strikes, most people find themselves paying significant out-of-pocket expenses that can drain savings, destroy credit, and derail financial futures.

Take the case of the Rodriguez family in Florida. When Hurricane Ian swept through their neighborhood in 2022, they discovered their standard policy didn’t cover flood damage. The result? Over $150,000 in uncompensated losses that nearly bankrupted them.

Key Insights:

- The average homeowners insurance claim is around $14,500

- Natural disasters caused over $165 billion in damages in 2022 alone

- Underinsurance can leave you vulnerable to catastrophic financial losses

Strategy 1: Comprehensive Coverage Beyond the Basics

Most homeowners make a critical mistake: they choose the cheapest policy without understanding what’s actually covered. A budget policy might save you $50 a month, but it could cost you hundreds of thousands when you need it most.

What to Look For:

- Replacement cost coverage vs. actual cash value

- Extended dwelling coverage

- Personal property protection

- Liability coverage limits

- Additional living expenses coverage

Pro Tip: Work with an independent insurance agent who can compare multiple carriers and find nuanced coverage that fits your specific risk profile.

Strategy 2: Risk Assessment – Know Your Property’s Unique Vulnerabilities

Not all homes are created equal. A Victorian-era home in New England faces different risks compared to a modern construction in California. Your insurance strategy must be as unique as your property.

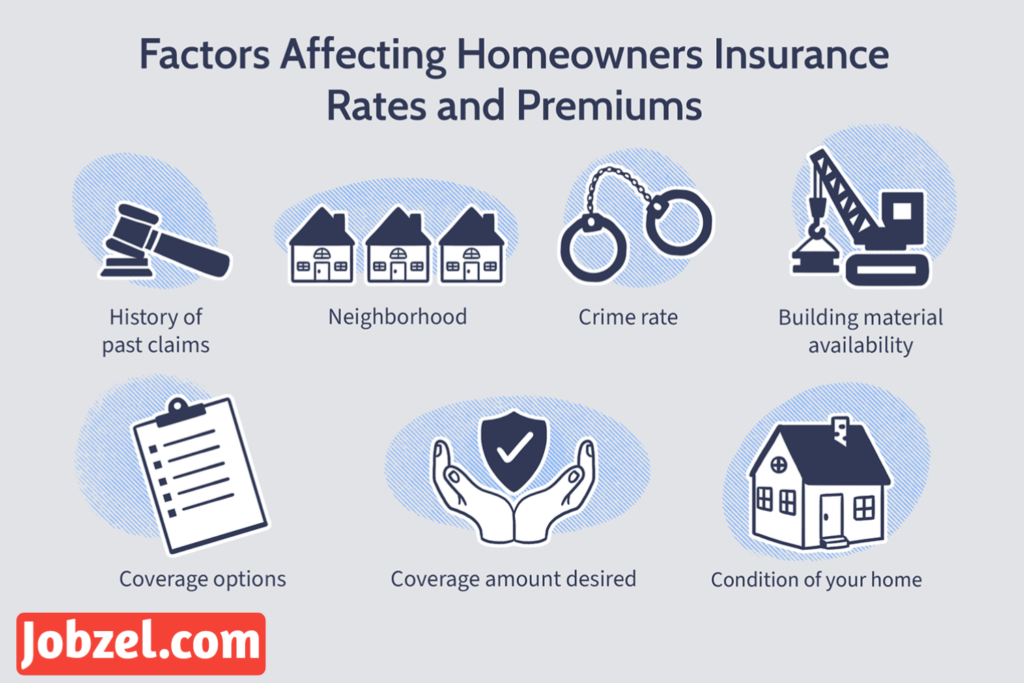

Factors that dramatically impact your insurance needs include:

- Age of home

- Construction materials

- Local climate risks

- Proximity to fire stations

- Crime rates in your neighborhood

Consider a home inspection that can help identify potential risk factors insurers will evaluate. This proactive approach can not only help you secure better coverage but potentially lower your premiums.

Strategy 3: The Power of Bundling and Smart Discounts

Insurance companies love customers who consolidate their policies. By bundling home and auto insurance, most homeowners can save between 15-25% on their total insurance costs.

But discounts go far beyond bundling. Smart homeowners can reduce premiums by:

- Installing security systems

- Adding storm shutters

- Upgrading electrical and plumbing systems

- Maintaining a good credit score

- Being claim-free for multiple years

Strategy 4: Regular Policy Reviews – The Annual Insurance Health Check

Your life changes. Your home changes. Your insurance should change too. An annual policy review can uncover:

- New coverage options

- Potential savings

- Emerging risks in your area

- Changes in home value

Experts recommend a comprehensive review every 12 months or after major life events like renovations, additions, or significant purchases.

Strategy 5: Understanding the Claims Process Before You Need It

When disaster strikes, the last thing you want is confusion about how to file a claim. Successful insurance navigation requires:

- Detailed home inventory

- Comprehensive documentation

- Understanding your policy’s claims process

- Knowing your rights as a policyholder

Pro Tip: Use smartphone apps or cloud storage to maintain a running, timestamped inventory of your home’s contents. This can be a lifesaver during the claims process.

The Bottom Line: Proactive Protection is Your Greatest Asset

Homeowners insurance isn’t an expense—it’s an investment in peace of mind. By implementing these strategies, you’re not just protecting a physical structure. You’re safeguarding your financial future, your memories, and your family’s security.

Final Recommendations:

- Get multiple quotes

- Understand your exact coverage

- Review annually

- Invest in risk mitigation

- Work with trusted professionals

Your home is more than just walls and a roof. It’s the backdrop of your life’s most precious moments. Protect it wisely.

Frequently Asked Questions

Q: How often should I update my homeowners insurance?

A: Annually, or after significant life changes like renovations, major purchases, or changes in property value.

Q: Are flood and earthquake damages typically covered?

A: Usually no. These require separate, specific policies that must be purchased additionally.

Q: Can I lower my premiums without sacrificing coverage?

A: Yes! Increasing your deductible, improving home security, and maintaining a good credit score can help reduce costs.

Ready to take control of your property protection? Start by scheduling a comprehensive insurance review today. Your future self will thank you.

IMPORTENT VIDEO LINK -:

![]()