With market volatility becoming increasingly common and traditional retirement accounts offering limited investment choices, savvy investors are turning to Self-Directed IRAs (SDIRAs) as a powerful tool for portfolio diversification. This comprehensive guide explores how Self-Directed IRAs can unlock unique investment opportunities while potentially maximizing your retirement savings through alternative assets.

Understanding Self-Directed IRAs: A Game-Changer for Retirement Planning

Many investors don’t realize that their traditional IRAs severely limit their investment options, typically restricting them to stocks, bonds, and mutual funds. Self-Directed IRAs break these barriers, allowing you to invest in a wide range of alternative assets while maintaining the same tax advantages as conventional IRAs.

The key difference lies in control. With an SDIRA, you’re not confined to the investment menu offered by your custodian. Instead, you have the freedom to invest in real estate, private equity, precious metals, cryptocurrency, and other alternative investments that could potentially generate higher returns than traditional options.

Alternative Investment Options in Self-Directed IRAs

Real Estate Investments

Real estate consistently ranks among the most popular SDIRA investments, offering both appreciation potential and steady income streams. Through your SDIRA, you can invest in:

- Residential rental properties

- Commercial real estate

- Real Estate Investment Trusts (REITs)

- Tax lien certificates

- Raw land

Consider the case of Michael, a software engineer who used his SDIRA to purchase a small apartment building. The rental income flows directly into his retirement account tax-deferred, while the property’s value has appreciated significantly over five years, substantially boosting his retirement portfolio.

Private Market Investments

Private market investments can offer potentially higher returns compared to public markets, though they typically come with higher risk. SDIRA options include:

- Private equity funds

- Startup investments

- Private lending

- Business partnerships

- Venture capital opportunities

Precious Metals and Commodities

Physical gold, silver, platinum, and palladium can serve as inflation hedges and portfolio diversifiers. SDIRAs allow you to hold these assets in approved depositories while maintaining their tax-advantaged status.

Key Benefits of Self-Directed IRA Investing

Portfolio Diversification

One of the primary advantages of SDIRAs is true portfolio diversification. While traditional IRAs might offer different types of stocks and bonds, SDIRAs allow you to invest in assets that often have low correlation with public markets, potentially reducing overall portfolio risk.

Tax Advantages

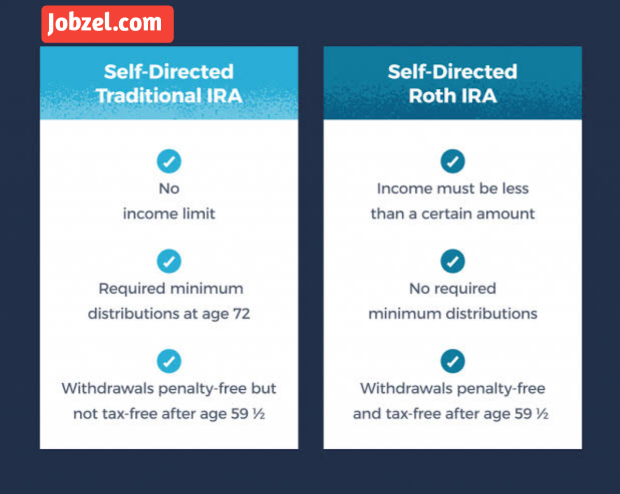

SDIRAs maintain the same tax benefits as traditional IRAs:

- Traditional SDIRA contributions may be tax-deductible

- Investments grow tax-deferred

- Roth SDIRA options offer tax-free growth and qualified withdrawals

- Opportunity for tax-free wealth transfer to beneficiaries

Investment Control

With an SDIRA, you’re not limited to the investment options chosen by your custodian. This control allows you to:

- Leverage your expertise in specific markets or industries

- React quickly to market opportunities

- Build a truly personalized retirement strategy

- Invest in assets you understand and believe in

Important Considerations and Risk Management

Due Diligence Requirements

Self-directed investing requires thorough due diligence. Before making any investment, consider:

- Asset valuation and potential returns

- Market conditions and trends

- Investment liquidity

- Risk factors and mitigation strategies

- Exit strategies

Prohibited Transactions

The IRS maintains strict rules about SDIRA investments. Prohibited transactions can result in your entire IRA being declared distributed, triggering taxes and penalties. Key restrictions include:

- No self-dealing or personal use of IRA assets

- No transactions with disqualified persons (including family members)

- No direct benefits from IRA investments before retirement

Custody and Administration

While you direct the investments, an IRS-approved custodian must hold the assets. This requires:

- Careful selection of a reputable custodian

- Understanding fee structures

- Maintaining proper documentation

- Regular account monitoring and reporting

Creating Your Self-Directed IRA Strategy

Step 1: Education and Planning

Before opening an SDIRA, invest time in:

- Learning about different investment options

- Understanding IRS rules and regulations

- Analyzing your risk tolerance

- Developing a comprehensive investment strategy

Step 2: Implementation

Once you’re ready to proceed:

- Choose a qualified custodian

- Complete the account setup process

- Transfer funds from existing retirement accounts if applicable

- Begin identifying investment opportunities

Step 3: Ongoing Management

Successful SDIRA investing requires:

- Regular portfolio monitoring

- Rebalancing when necessary

- Staying informed about market conditions

- Maintaining proper documentation

Conclusion: Taking Control of Your Retirement Future

Self-Directed IRAs represent a powerful tool for investors seeking greater control over their retirement savings and access to alternative investments. While they require more hands-on management and careful attention to regulations, the potential benefits of portfolio diversification and investment flexibility make them worth considering for many sophisticated investors.

Ready to explore whether a Self-Directed IRA aligns with your retirement goals? Consider scheduling a consultation with a qualified financial advisor who specializes in alternative investments and SDIRA strategies. They can help you evaluate whether this powerful investment vehicle could enhance your retirement planning approach and guide you through the setup process.

Remember, successful retirement planning often requires thinking beyond traditional investment options. A Self-Directed IRA might be the key to unlocking new opportunities and building the retirement portfolio you envision.

![]()